<--- Back to Details

| First Page | Document Content | |

|---|---|---|

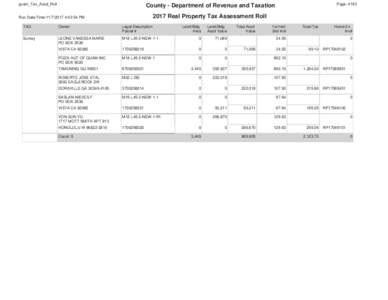

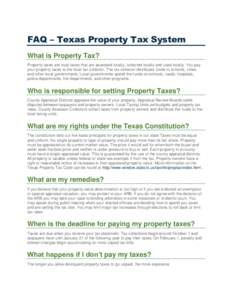

Date: 2014-05-13 14:07:06Land law Real property law Mortgage Real estate appraisal Macromedia HomeSite Property tax Valuation Appraiser Market value Real estate Financial markets Finance |

Add to Reading List |

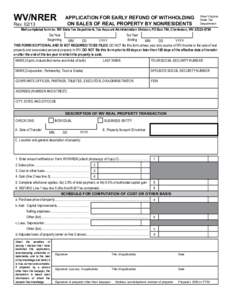

BEFORE THE IDAHO BOARD OF TAX APPEALS IN THE MATTER OF THE APPEAL OF GLENN AND VIVIAN WAY from a decision of the Benewah County Board of Equalization for tax year 2013.

BEFORE THE IDAHO BOARD OF TAX APPEALS IN THE MATTER OF THE APPEAL OF GLENN AND VIVIAN WAY from a decision of the Benewah County Board of Equalization for tax year 2013.