<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2015-01-02 13:31:05Law Medical savings account Above-the-line deduction Income tax in the United States Medicare Internal Revenue Code Adjusted gross income Federal Insurance Contributions Act tax Estate tax in the United States Taxation in the United States Government Economy of the United States |

Add to Reading List |

| 2016_SHOP_RateSheet_8.5x11_04252016DocID: 1rjFx - View Document |

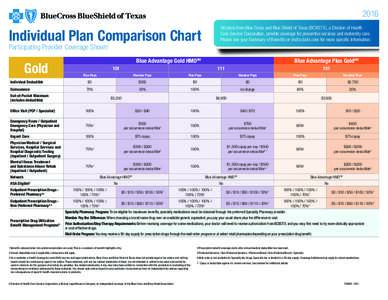

| 2016 All plans from Blue Cross and Blue Shield of Texas (BCBSTX), a Division of Health Care Service Corporation, provide coverage for preventive services and maternity care. Please see your Summary of Benefits or visit bDocID: 1rjEc - View Document |

| The International Major Medical Plan FOR • • • •DocID: 1r0HB - View Document |

| Leadership update 2015 medical and wellness plansDocID: 1qJ1N - View Document |

| Health Opportunities you want. Benefits you need. Medical Plans Staples offers consumer-driven health care plans to its associates. These plans include a number ofDocID: 1qyYA - View Document |

SCS Agency Franchise Tax Board Author: ANALYSIS OF AMENDED BILL

SCS Agency Franchise Tax Board Author: ANALYSIS OF AMENDED BILL