<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2004-12-03 11:59:37Donation Itemized deduction Public economics Gross income Finance Tax Business Gift Charitable contribution deductions in the United States Taxation in the United States Taxation Income tax in the United States |

Add to Reading List |

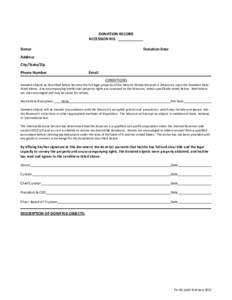

ALTB[removed]CHARITABLE CONTRIBUTIONS OF COMMODITIES Abstract For some farmers, making a charitable contribution in kind, rather than cash can increase the tax benefit of the gift. The tax consequences of the gift differs

ALTB[removed]CHARITABLE CONTRIBUTIONS OF COMMODITIES Abstract For some farmers, making a charitable contribution in kind, rather than cash can increase the tax benefit of the gift. The tax consequences of the gift differs