<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2014-06-18 09:32:00Government Employee benefit IRS tax forms Social Security Long-term care insurance Adjusted gross income Politics Finance Itemized deduction Taxation in the United States Income tax in the United States Gross income |

Add to Reading List |

ZIP Code Data Documentation Guide Tax Year 2004 What the Data Show ZIP Code Data show selected income and tax items classified by state, ZIP code, and size of adjusted gross income. The data are based on administrativeDocID: 1tXMK - View Document | |

| American Indian and Alaska Native Trust Income and MAGI Q : What is Modified Adjusted Gross Income (MAGI)? A : MAGI is your adjusted gross income, as determined for federal income tax purposes, with certain types ofDocID: 1sHcx - View Document |

| Microsoft Word - Tax Expenditures.docDocID: 1rkU5 - View Document |

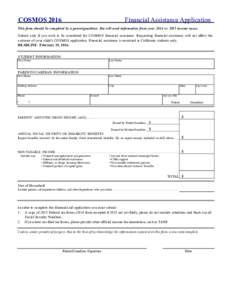

| COSMOS 2016 Financial Assistance ApplicationDocID: 1rh9e - View Document |

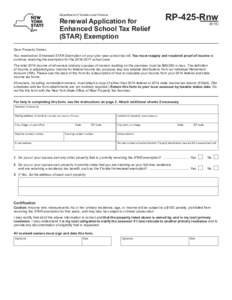

| Department of Taxation and Finance Renewal Application for Enhanced School Tax Relief (STAR) ExemptionDocID: 1rek5 - View Document |

Reset Form DTE 105H Rev[removed]Addendum to the Homestead Exemption Application for

Reset Form DTE 105H Rev[removed]Addendum to the Homestead Exemption Application for