<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2014-09-10 09:12:37Income tax in the United States Public economics Income tax in Australia Tax Political economy Government Housing Benefit Social Security Taxation in the United Kingdom British society Personal allowance |

Add to Reading List |

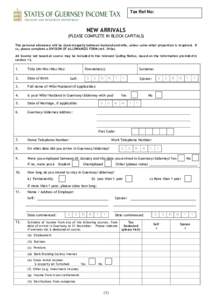

The Treasury Yn Tashtey Income Tax Division Government Office, Douglas Isle of Man, British Isles

The Treasury Yn Tashtey Income Tax Division Government Office, Douglas Isle of Man, British Isles