<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2017-10-26 11:14:09Economy Business Value added taxes Invoice Tax European Union value added tax Sales taxes Ad valorem tax |

Add to Reading List |

| International Tax Insight July 2013 Editorial Welcome to the latest edition of Baker Tilly International’s premier tax publication. In an increasingly globalised world, the following content aims to cover key taxDocID: 1rraT - View Document |

DOC DocumentDocID: 1re1N - View Document | |

| Microsoft PowerPoint - M2.3 SUT specific issuesDocID: 1rb8C - View Document |

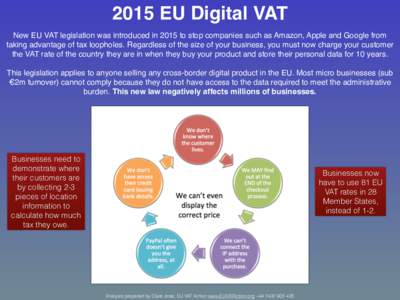

| 2015 EU Digital VAT New EU VAT legislation was introduced in 2015 to stop companies such as Amazon, Apple and Google from taking advantage of tax loopholes. Regardless of the size of your business, you must now charge yoDocID: 1r7L6 - View Document |

| swiss economics Impact of VAT-Exemptions in the Postal Sector on Competition and Welfare European Commission, DG Internal Market and ServicesDocID: 1r459 - View Document |

A countdown to VAT in GCC, are you ready? On January 1, 2018, value-added tax (VAT) will come into effect for the first time in the GCC. However, each member state of the GCC will establish their own

A countdown to VAT in GCC, are you ready? On January 1, 2018, value-added tax (VAT) will come into effect for the first time in the GCC. However, each member state of the GCC will establish their own