<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2014-03-26 09:46:13United States federal banking legislation Banking in the United States Capital requirement Dodd–Frank Wall Street Reform and Consumer Protection Act Ally Bank Ally Financial Troubled Asset Relief Program Federal Deposit Insurance Corporation Basel II Financial services Finance Financial economics |

Add to Reading List |

| WINTON CAPITAL MANAGEMENT LIMITED Capital Requirement Directive Pillar 3 Disclosure In respect of the year ended 31 December 2015DocID: 1rDw1 - View Document |

| Rothesay Assurance Limited Annual PRA Insurance Returns for the year ended 31 December 2014DocID: 1rsZ9 - View Document |

| EBF_021542 - EBF_paper on expected losses 7th June.docxDocID: 1rrNm - View Document |

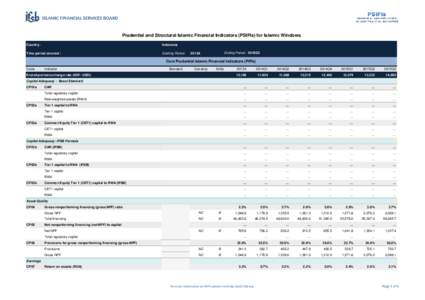

| Prudential and Structural Islamic Financial Indicators (PSIFIs) for Islamic Windows Country: Indonesia Time period covered :DocID: 1rrms - View Document |

| Disclosures (Consolidated basis) under Pillar 3 in terms of New Capital Adequacy Framework (Basel III) of Reserve Bank of India as onDF 2. Capital Adequacy (a) Bank maintains capital to cushion the risk of loDocID: 1rqmd - View Document |

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.CForm 10-K

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.CForm 10-K