<--- Back to Details

| First Page | Document Content | |

|---|---|---|

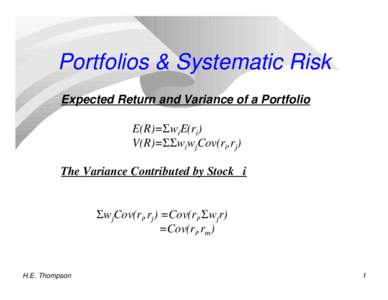

Date: 2012-11-18 17:52:07Psychometrics Design of experiments Intelligence Statistical tests Hypothesis testing Analysis of variance Factor analysis Seasonality G factor Errors and residuals Variance Statistical hypothesis testing |

Add to Reading List |

AACL BIOFLUX Aquaculture, Aquarium, Conservation & Legislation International Journal of the Bioflux Society Evaluation of seasonal variations in physicochemical parameters of Taleghan River, northern Iran

AACL BIOFLUX Aquaculture, Aquarium, Conservation & Legislation International Journal of the Bioflux Society Evaluation of seasonal variations in physicochemical parameters of Taleghan River, northern Iran