<--- Back to Details

| First Page | Document Content | |

|---|---|---|

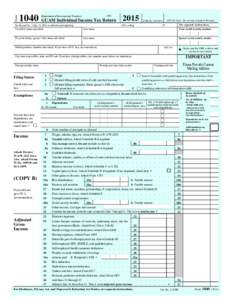

Date: 2014-12-09 16:38:58Government Social Security M.I Political economy Child tax credit Head of Household Taxation in the United States Earned income tax credit Public economics |

Add to Reading List |

| WHAT’S NEW FOR LOUISIANA 2015 INDIVIDUAL INCOME TAX? Education Credit – Line 13 - Resident taxpayers are allowed a credit of $18 for each child attending a kindergarten, elementary, or secondary school (kindergartenDocID: 1t5m2 - View Document |

| A New Vision for Child Care in the United States A Proposed New Tax Credit to Expand High-Quality Child Care By Katie Hamm and Carmel Martin September 2015DocID: 1sJ5E - View Document |

| The Earned Income Tax Credit and Child Achievement Samuel M. Lundstrom University of California, Irvine November, 2015DocID: 1rui4 - View Document |

| Treating Parents Fairly Robert VerBruggen T he ch a llenge s i n volv ed in balancing work and family leadDocID: 1rpTC - View Document |

| PDF DocumentDocID: 1r5Ed - View Document |

File pg. 4 SOCIAL SECURITY NUMBER Schedule DI Dependent Information. Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules[removed]

File pg. 4 SOCIAL SECURITY NUMBER Schedule DI Dependent Information. Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules[removed]