<--- Back to Details

| First Page | Document Content | |

|---|---|---|

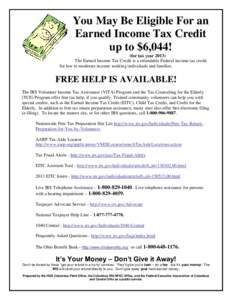

Date: 2013-08-31 22:11:22Government Social Security M.I Political economy Child tax credit Head of Household Taxation in the United States Earned income tax credit Public economics |

Add to Reading List |

File pg. 4 SOCIAL SECURITY NUMBER Schedule DI Dependent Information Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules.

File pg. 4 SOCIAL SECURITY NUMBER Schedule DI Dependent Information Enclose with Form 1 or Form 1-NR/PY. Do not cut or separate these schedules.