<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2009-11-30 20:46:33Mathematical finance Fixed income analysis Heath–Jarrow–Morton framework Path integral formulation Propagator Model theory Lagrangian Physics Quantum field theory Quantum mechanics |

Add to Reading List |

| An Experimental Study of Bond Market Pricing∗ Matthias Weber† John Duffy‡ Arthur Schram§DocID: 1roHP - View Document |

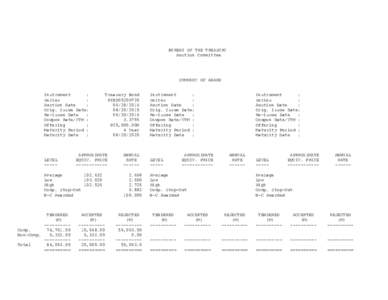

| BUREAU OF THE TREASURY Auction Committee SUMMARY OF AWARD Instrument :DocID: 1rjIW - View Document |

| When volatility is low but uncertainty is high….…buy interest rate options. There is something of a conundrum in interest rate markets at the moment. Market View 1 (Thinking uncertainty): Bond rates are near long-runDocID: 1rjeG - View Document |

| http://www.frankfabozzi.com/tutorials/fia.htmDocID: 1rjc8 - View Document |

| Procedure For The Submission and ReviewDocID: 1riE1 - View Document |

June 20, [removed]:58 WSPC/104-IJTAF[removed]International Journal of Theoretical and Applied Finance Vol. 6, No[removed]–467

June 20, [removed]:58 WSPC/104-IJTAF[removed]International Journal of Theoretical and Applied Finance Vol. 6, No[removed]–467