<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2015-05-07 09:03:15Political economy European Union law European Union value added tax Accountancy Value Added Tax Tax Ad valorem tax Taxation of Digital Goods Value added taxes Public economics Taxation |

Add to Reading List |

| International Tax Insight July 2013 Editorial Welcome to the latest edition of Baker Tilly International’s premier tax publication. In an increasingly globalised world, the following content aims to cover key taxDocID: 1rraT - View Document |

DOC DocumentDocID: 1re1N - View Document | |

| Microsoft PowerPoint - M2.3 SUT specific issuesDocID: 1rb8C - View Document |

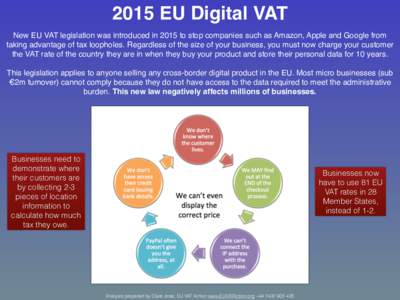

| 2015 EU Digital VAT New EU VAT legislation was introduced in 2015 to stop companies such as Amazon, Apple and Google from taking advantage of tax loopholes. Regardless of the size of your business, you must now charge yoDocID: 1r7L6 - View Document |

| swiss economics Impact of VAT-Exemptions in the Postal Sector on Competition and Welfare European Commission, DG Internal Market and ServicesDocID: 1r459 - View Document |

VAT on digital services Standard Note: SN7075 Last updated:

VAT on digital services Standard Note: SN7075 Last updated: