<--- Back to Details

| First Page | Document Content | |

|---|---|---|

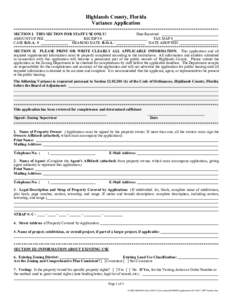

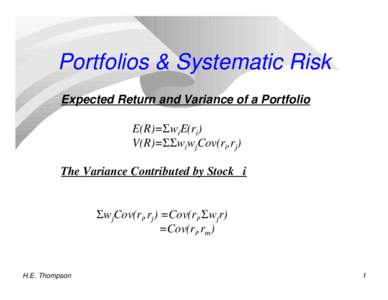

Date: 2015-04-21 13:14:53Regression analysis Statistics Estimation theory Simultaneous equation methods Parametric statistics Statistical models Instrumental variable Endogeneity Ordinary least squares Variance Dependent and independent variables Linear regression |

Add to Reading List |

Microsoft PowerPoint - iv

Microsoft PowerPoint - iv