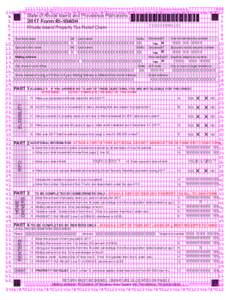

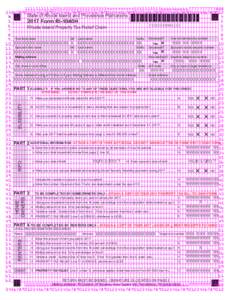

Date: 2010-10-15 14:50:27Competition Conservatism in the United States Education policy School choice Scholarship Tuition payments Tax credit Iowa Alliance for Choice in Education Education Student financial aid Knowledge | |  CORPORATE INCOME AND INSURANCE PREMIUM TAX CREDITS FOR CONTRIBUTIONS TO SCHOOL TUITION ORGANIZATIONS FOR SCHOLARSHIPS FOR DISABLED/DISPLACED STUDENTS REPORTING FOR 2009 The corporate income tax credit and insurance premi CORPORATE INCOME AND INSURANCE PREMIUM TAX CREDITS FOR CONTRIBUTIONS TO SCHOOL TUITION ORGANIZATIONS FOR SCHOLARSHIPS FOR DISABLED/DISPLACED STUDENTS REPORTING FOR 2009 The corporate income tax credit and insurance premi

Add to Reading ListSource URL: www.azdor.govDownload Document from Source Website File Size: 132,57 KBShare Document on Facebook

|

CORPORATE INCOME AND INSURANCE PREMIUM TAX CREDITS FOR CONTRIBUTIONS TO SCHOOL TUITION ORGANIZATIONS FOR SCHOLARSHIPS FOR DISABLED/DISPLACED STUDENTS REPORTING FOR 2009 The corporate income tax credit and insurance premi

CORPORATE INCOME AND INSURANCE PREMIUM TAX CREDITS FOR CONTRIBUTIONS TO SCHOOL TUITION ORGANIZATIONS FOR SCHOLARSHIPS FOR DISABLED/DISPLACED STUDENTS REPORTING FOR 2009 The corporate income tax credit and insurance premi