<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2014-07-04 05:17:51Financial regulation Financial economics Banking in Canada Office of the Superintendent of Financial Institutions Julie Dickson Capital requirement International Financial Reporting Standards Financial statement Late-2000s financial crisis Insurance Economics Finance |

Add to Reading List |

| WINTON CAPITAL MANAGEMENT LIMITED Capital Requirement Directive Pillar 3 Disclosure In respect of the year ended 31 December 2015DocID: 1rDw1 - View Document |

| Rothesay Assurance Limited Annual PRA Insurance Returns for the year ended 31 December 2014DocID: 1rsZ9 - View Document |

| EBF_021542 - EBF_paper on expected losses 7th June.docxDocID: 1rrNm - View Document |

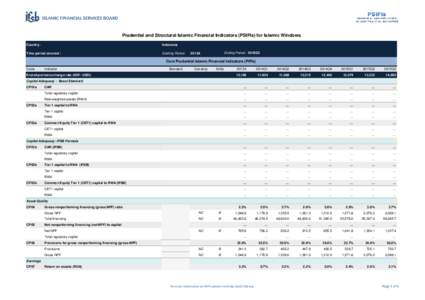

| Prudential and Structural Islamic Financial Indicators (PSIFIs) for Islamic Windows Country: Indonesia Time period covered :DocID: 1rrms - View Document |

| Disclosures (Consolidated basis) under Pillar 3 in terms of New Capital Adequacy Framework (Basel III) of Reserve Bank of India as onDF 2. Capital Adequacy (a) Bank maintains capital to cushion the risk of loDocID: 1rqmd - View Document |

Financial Highlights For the Period Ended September 30, 2013

Financial Highlights For the Period Ended September 30, 2013