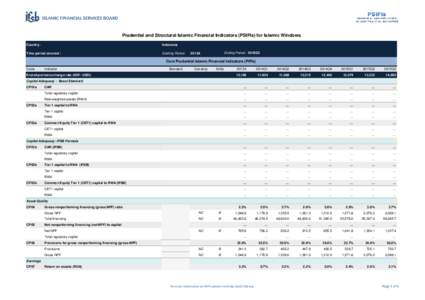

Date: 2011-07-20 20:00:00Financial economics Investment Systemic risk Basel III Tier 1 capital Capital requirement Tier 2 capital Capital adequacy ratio Credit risk Banking Finance Bank regulation | |  Results of the 2011 EBA EU-wide stress test: Summary[removed]Name of the bank: KBC Bank Actual results at 31 December 2010 Operating profit before impairments Impairment losses on financial and non-financial assets in the Results of the 2011 EBA EU-wide stress test: Summary[removed]Name of the bank: KBC Bank Actual results at 31 December 2010 Operating profit before impairments Impairment losses on financial and non-financial assets in the

Add to Reading ListSource URL: www.eba.europa.euDownload Document from Source Website File Size: 476,56 KBShare Document on Facebook

|

Results of the 2011 EBA EU-wide stress test: Summary[removed]Name of the bank: KBC Bank Actual results at 31 December 2010 Operating profit before impairments Impairment losses on financial and non-financial assets in the

Results of the 2011 EBA EU-wide stress test: Summary[removed]Name of the bank: KBC Bank Actual results at 31 December 2010 Operating profit before impairments Impairment losses on financial and non-financial assets in the