<--- Back to Details

| First Page | Document Content | |

|---|---|---|

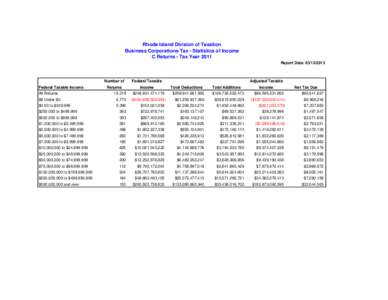

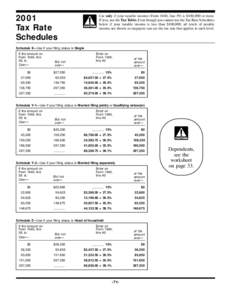

Date: 2014-10-26 17:04:12Business IRS tax forms Internal Revenue Service Depreciation Taxable income Net income Finance Taxation Generally Accepted Accounting Principles Accountancy |

Add to Reading List |

SCHEDULE KCR-C Form 720 41A720KCR-C[removed])

SCHEDULE KCR-C Form 720 41A720KCR-C[removed])