<--- Back to Details

| First Page | Document Content | |

|---|---|---|

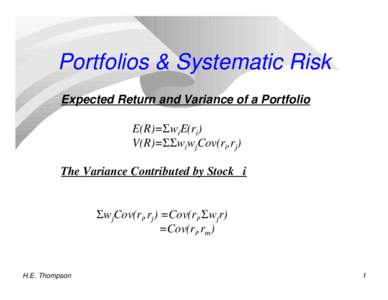

Date: 2001-11-05 13:11:35Statistics Regression analysis Autocorrelation Linear regression Polynomial regression Nonparametric regression Kernel regression Correlation and dependence Errors and residuals Degrees of freedom Variance Normal distribution |

Add to Reading List |

Nonparametric Regression with Correlated Errors Jean Opsomer Iowa State University Yuedong Wang University of California, Santa Barbara

Nonparametric Regression with Correlated Errors Jean Opsomer Iowa State University Yuedong Wang University of California, Santa Barbara