<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2014-08-13 20:59:00Taxable income Casualty loss Rate of return Income taxes Public economics Finance Political economy Internal Revenue Code section 183 Income tax in the United States Taxation in the United States Taxation Itemized deduction |

Add to Reading List |

ZIP Code Data Tax Year 2013 Documentation Guide ContentsDocID: 1qXtL - View Document | |

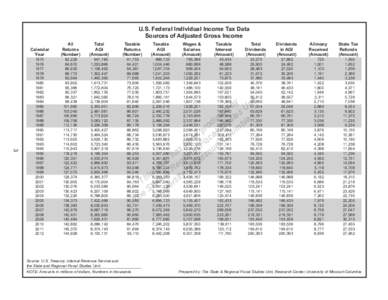

| U.S. Federal Individual Income Tax Data Sources of Adjusted Gross Income Calendar Year 3DocID: 1qS7K - View Document |

| Ernst & Young LLP SuiteMission Street San Francisco, CaliforniaPhone: (www.ey.comDocID: 1qO2L - View Document |

| Form 990-PF Department of the Treasury Internal Revenue ServiceDocID: 1qJH0 - View Document |

ZIP Code Data Tax Year 2012 Documentation Guide ContentsDocID: 1qHzh - View Document |

SCHEDULE KNOL 42A740-KNOL Department of Revenue *[removed]*

SCHEDULE KNOL 42A740-KNOL Department of Revenue *[removed]*