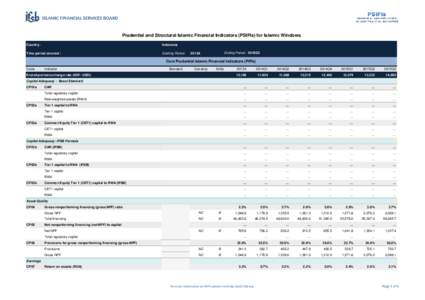

Date: 2013-11-05 12:55:48Banking Credit Financial ratios Risk Standardized approach Basel II Capital adequacy ratio Tier 1 capital Capital requirement Financial economics Finance Economics | |  o Capital Adequacy Framework • In addition to the prescribed minimum levels of capital, Philippine banks were required to maintain a net worth-to-risk assets (NWRA) ratio of at least 10%. (Sec. 22 of R. A. No. 337) o Capital Adequacy Framework • In addition to the prescribed minimum levels of capital, Philippine banks were required to maintain a net worth-to-risk assets (NWRA) ratio of at least 10%. (Sec. 22 of R. A. No. 337)

Add to Reading ListSource URL: www.bsp.gov.phDownload Document from Source Website File Size: 53,14 KBShare Document on Facebook

|

o Capital Adequacy Framework • In addition to the prescribed minimum levels of capital, Philippine banks were required to maintain a net worth-to-risk assets (NWRA) ratio of at least 10%. (Sec. 22 of R. A. No. 337)

o Capital Adequacy Framework • In addition to the prescribed minimum levels of capital, Philippine banks were required to maintain a net worth-to-risk assets (NWRA) ratio of at least 10%. (Sec. 22 of R. A. No. 337)