<--- Back to Details

| First Page | Document Content | |

|---|---|---|

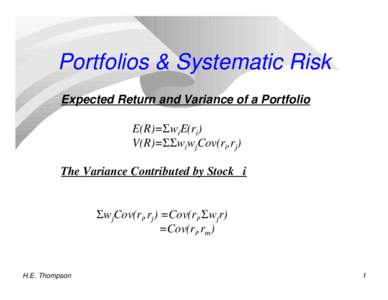

Date: 2012-06-05 16:12:53Probability theory Logistic distribution Log-logistic distribution Pareto distribution Logistic function Random variable Exponential distribution Variance Moment Statistics Mathematical analysis Probability and statistics |