<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2002-02-13 11:52:00Itemized deduction Lon Nol IRS tax forms Taxable income Casualty loss Internal Revenue Code section 1 Politics Cancellation of Debt (COD) Income Taxation in the United States Government Net operating loss |

Add to Reading List |

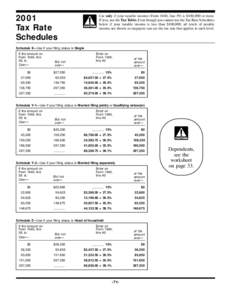

TAXABLE YEARNet Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations — Individuals, Estates, and Trusts

TAXABLE YEARNet Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations — Individuals, Estates, and Trusts