<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2013-04-30 14:17:51Tax assessment Tax Economics Business Money Property tax in the United States Municipal Property Assessment Corporation Property taxes Real property law Property tax |

Add to Reading List |

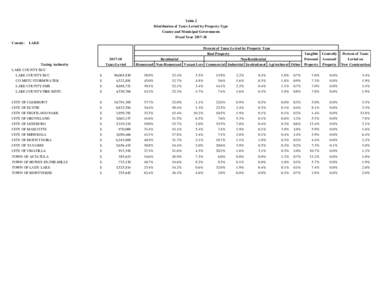

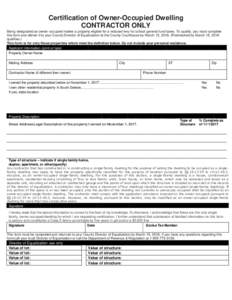

April 2013 PA-502 Assessment and Tax Roll Instructions for Clerks

April 2013 PA-502 Assessment and Tax Roll Instructions for Clerks