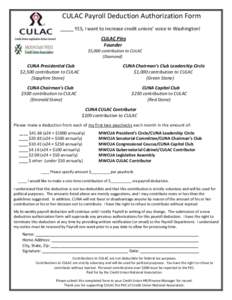

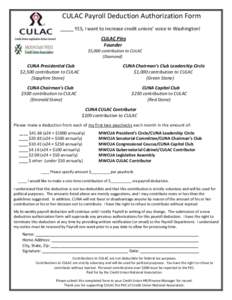

Date: 2014-10-15 19:51:53Expense Payroll Credit Union National Association Federal Insurance Contributions Act tax Tax deduction Accountancy Economy of the United States Public economics Employment compensation Withholding taxes Taxation | |  CULAC Payroll Deduction Authorization Form _____ YES, I want to increase credit unions’ voice in Washington! CULAC Pins Founder $5,000 contribution to CULAC (Diamond) CULAC Payroll Deduction Authorization Form _____ YES, I want to increase credit unions’ voice in Washington! CULAC Pins Founder $5,000 contribution to CULAC (Diamond)

Add to Reading ListSource URL: mwcua.comDownload Document from Source Website File Size: 414,22 KBShare Document on Facebook

|

CULAC Payroll Deduction Authorization Form _____ YES, I want to increase credit unions’ voice in Washington! CULAC Pins Founder $5,000 contribution to CULAC (Diamond)

CULAC Payroll Deduction Authorization Form _____ YES, I want to increase credit unions’ voice in Washington! CULAC Pins Founder $5,000 contribution to CULAC (Diamond)