<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2013-08-31 22:10:56Internal Revenue Service Royalties Renting Economics Depreciation Business Law Adjusted gross income Negative gearing Taxation in the United States Taxation IRS tax forms |

Add to Reading List |

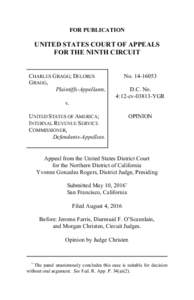

2009 Schedule E-1 Rental Real Estate and Royalty Income and (Loss)

2009 Schedule E-1 Rental Real Estate and Royalty Income and (Loss)