<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2009-07-09 10:28:08Oklahoma State Board of Equalization Property taxes Real property law Property tax in the United States |

Add to Reading List |

| PROPERTY CLASSIFICATIONS The Assessor’s Office determines the correct classification of property in the County. There are different classifications of property such as: 4%, Owner Occupied Residential, The market valueDocID: 1rub8 - View Document |

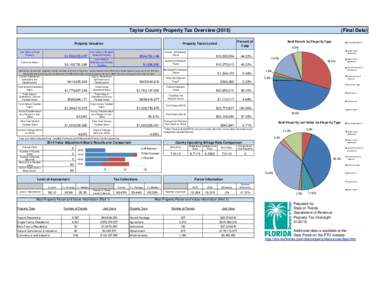

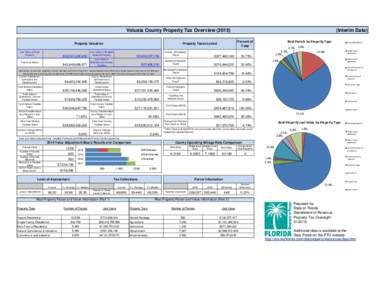

| 2015 County Profiles.xlsxDocID: 1rtUB - View Document |

| PDF DocumentDocID: 1rtzd - View Document |

| 2015 County Profiles.xlsxDocID: 1rsgJ - View Document |

| 2015 County Profiles.xlsxDocID: 1rrvX - View Document |

EQUALIZATION BOARD ABSTRACT OF ADJUSTED ASSESSMENT A report by total of items and value, showing the total assessment of all property in _________________ County for the year 20___, that is required by law to be assessed

EQUALIZATION BOARD ABSTRACT OF ADJUSTED ASSESSMENT A report by total of items and value, showing the total assessment of all property in _________________ County for the year 20___, that is required by law to be assessed