<--- Back to Details

| First Page | Document Content | |

|---|---|---|

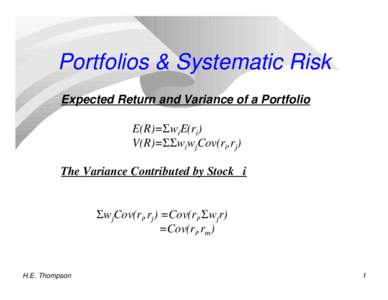

Date: 2011-11-17 10:33:22Data analysis Singular value decomposition Principal component analysis Econometrics XLSTAT Eigenvalues and eigenvectors Regression analysis Biplot Variance Statistics Algebra Multivariate statistics |

Add to Reading List |

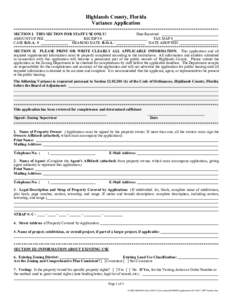

Running a Principal Component Analysis (PCA) with XLSTAT demoPCA.xls Dataset for running a Principal Component Analysis An Excel sheet containing both the data and the results for use in this tutorial can be downloaded

Running a Principal Component Analysis (PCA) with XLSTAT demoPCA.xls Dataset for running a Principal Component Analysis An Excel sheet containing both the data and the results for use in this tutorial can be downloaded