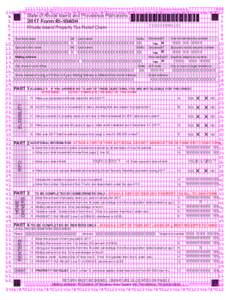

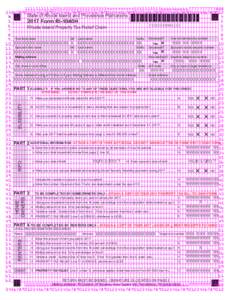

Date: 2012-10-26 22:03:03Taxation Business Government Income tax in the United States Public economics Tax return Tax credit Cheque Tax withholding in the United States Taxation in the United States Internal Revenue Service IRS tax forms | |  Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file Copy A downloaded from this website. You can only file printed versions of Copy A tha Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file Copy A downloaded from this website. You can only file printed versions of Copy A tha

Add to Reading ListSource URL: www.irs.govDownload Document from Source Website File Size: 121,85 KBShare Document on Facebook

|

Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file Copy A downloaded from this website. You can only file printed versions of Copy A tha

Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do not file Copy A downloaded from this website. You can only file printed versions of Copy A tha