<--- Back to Details

| First Page | Document Content | |

|---|---|---|

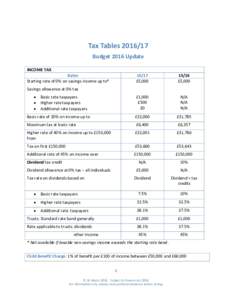

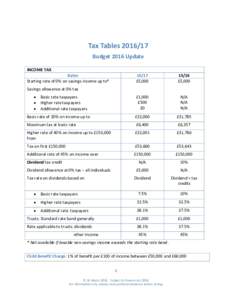

Taxation in the United Kingdom Taxation Capital gains tax Income tax Dividend tax National Insurance Tax Corporate tax Estate tax in the United States Taxation in Gibraltar |

Add to Reading List |

| First Page | Document Content | |

|---|---|---|

Taxation in the United Kingdom Taxation Capital gains tax Income tax Dividend tax National Insurance Tax Corporate tax Estate tax in the United States Taxation in Gibraltar |

Add to Reading List |