<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2015-01-02 13:04:09Economy of the United States Public economics Withholding tax Internal Revenue Code section Installment sale Escrow IRS tax forms Pay-as-you-earn tax Tax Taxation in the United States Real property law Law |

Add to Reading List |

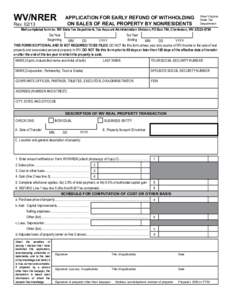

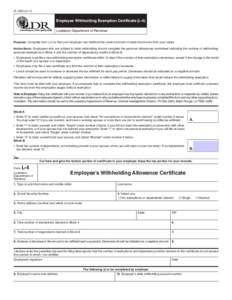

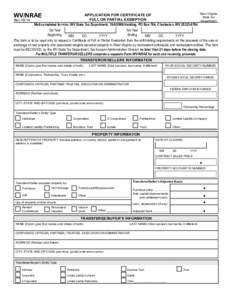

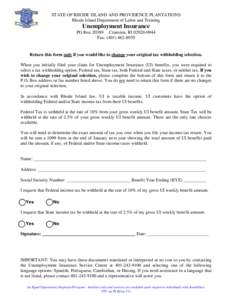

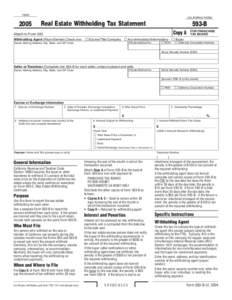

2005 Real Estate Withholding Tax Statement

2005 Real Estate Withholding Tax Statement