<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2013-10-31 22:07:49Revenue ruling Charitable remainder unitrust Commissioner v. Idaho Power Co. Taxation in the United States Internal Revenue Service Income tax in the United States |

Add to Reading List |

| Other Types of Bequests Certain types of property pass outside of a will or trust. These assets require that you name a beneficiary by completing a beneficiary designation form. To make a bequest of these assets, you shoDocID: 1rar6 - View Document |

| PDF DocumentDocID: 1r8wq - View Document |

| Gift Aid declaration Single donation Boost your donation by 25p of Gift Aid for every £1 you donate. Gift Aid is reclaimed by the charity from the tax you pay for the current tax year. Your address is needed to identifyDocID: 1pb7j - View Document |

FROM NASCAR CONDOMINIUMS TO PRIVATE MAUSOLEUMS:DocID: 1oRTJ - View Document | |

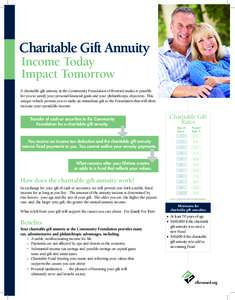

| Senior Couple Relaxing On Sofa At HomeDocID: 1oOwc - View Document |

Internal Revenue Service Department of the Treasury Number: Release Date:

Internal Revenue Service Department of the Treasury Number: Release Date: