Date: 2014-02-05 22:32:22Internal Revenue Code Finance Internal Revenue Service Personal finance Income tax in the United States Individual retirement account Tax return Tax credit 403 Financial economics Taxation in the United States Individual Retirement Accounts | |  How Uncle Sam Helps You Save For Retirement (NAPS)—If you ever feel your finances are too stretched to save for retirement, there could be good news for you. The Saver ’s Credit—a little-known tax credit How Uncle Sam Helps You Save For Retirement (NAPS)—If you ever feel your finances are too stretched to save for retirement, there could be good news for you. The Saver ’s Credit—a little-known tax credit

Add to Reading ListSource URL: www.transamericacenter.orgDownload Document from Source Website File Size: 116,41 KBShare Document on Facebook

|

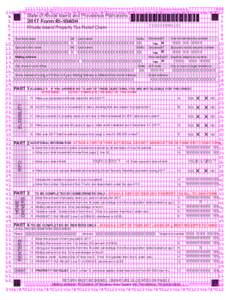

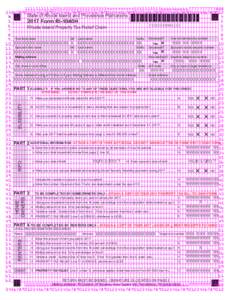

How Uncle Sam Helps You Save For Retirement (NAPS)—If you ever feel your finances are too stretched to save for retirement, there could be good news for you. The Saver ’s Credit—a little-known tax credit

How Uncle Sam Helps You Save For Retirement (NAPS)—If you ever feel your finances are too stretched to save for retirement, there could be good news for you. The Saver ’s Credit—a little-known tax credit