<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2012-11-29 09:26:08Expense Payroll Prevailing wage Federal Insurance Contributions Act tax Social Security Davis–Bacon Act Subcontractor Accountancy Law Employment compensation Taxation in the United States Withholding taxes |

Add to Reading List |

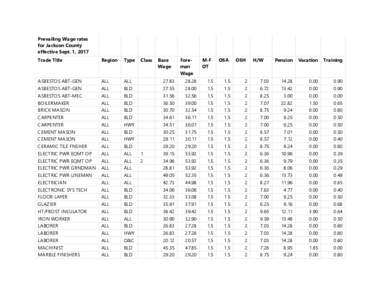

| Prevailing Wage rates for Jackson County effective Sept. 1, 2017 Trade Title RegionDocID: 1voQm - View Document |

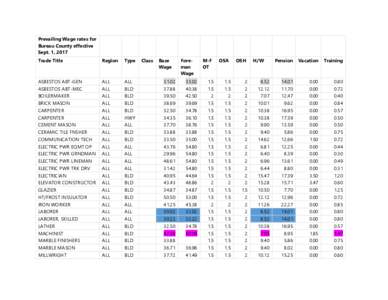

| Prevailing Wage rates for Bureau County effective Sept. 1, 2017 Trade Title RegionDocID: 1vncv - View Document |

| Prevailing Wage rates for Cook County effective Sept. 1, 2017 Trade Title RegionDocID: 1vhOG - View Document |

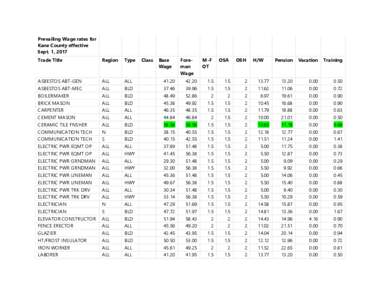

| Prevailing Wage rates for Kane County effective Sept. 1, 2017 Trade Title RegionDocID: 1vhcQ - View Document |

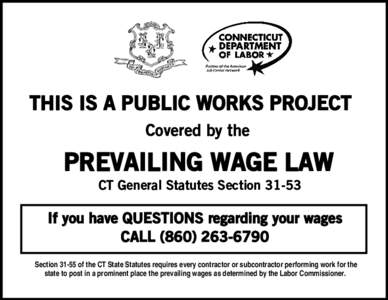

| THIS IS A PUBLIC WORKS PROJECT Covered by the PREVAILING WAGE LAW CT General Statutes Section 31-53DocID: 1vf3X - View Document |

U.S. Department of Labor PAYROLL Employment Standards Administration Wage and Hour Division

U.S. Department of Labor PAYROLL Employment Standards Administration Wage and Hour Division