<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2015-05-14 10:50:23World Bank Hedge Currency swap Derivative Interest rate swap Swap International Bank for Reconstruction and Development Floating interest rate Interest rate cap and floor Finance Financial economics Investment |

Add to Reading List |

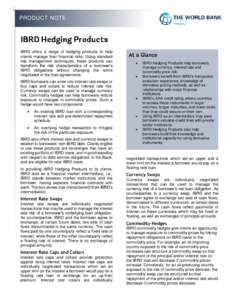

PRODUCT NOTE IBRD offers a range of hedging products to help clients manage their financial risks. Using standard risk management techniques, these products can transform the risk characteristics of a borrower’s

PRODUCT NOTE IBRD offers a range of hedging products to help clients manage their financial risks. Using standard risk management techniques, these products can transform the risk characteristics of a borrower’s