<--- Back to Details

| First Page | Document Content | |

|---|---|---|

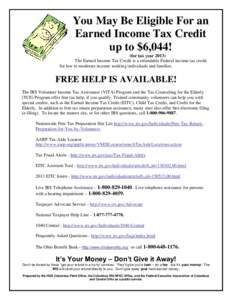

Date: 2014-12-02 15:18:00Financial economics IRS tax forms Alternative Minimum Tax Internal Revenue Code section Earned income tax credit Traditional IRA Tax return Roth IRA Internal Revenue Service Taxation in the United States Investment Public economics |

Add to Reading List |

Tax Deduction Locator & IRS Trouble Minimizer Provided By: SAVE TIME – READ THIS FIRST

Tax Deduction Locator & IRS Trouble Minimizer Provided By: SAVE TIME – READ THIS FIRST