<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 2015-05-02 15:50:41Types of business entity Legal entities Business law Corporate law Corporate taxation in the United States Limited liability company Limited partnership Corporate tax Business Public-benefit corporation Legal personality Joint-stock company |

Add to Reading List |

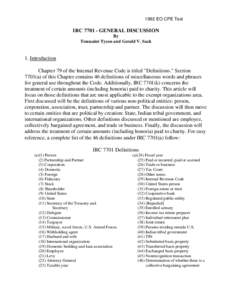

1992 EO CPE Text IRCGENERAL DISCUSSION By Toussaint Tyson and Gerald V. Sack

1992 EO CPE Text IRCGENERAL DISCUSSION By Toussaint Tyson and Gerald V. Sack