<--- Back to Details

| First Page | Document Content | |

|---|---|---|

Date: 1999-01-07 11:13:18Taxation in the United States Income taxes Tax Dividend Public economics Political economy Income tax in the United States Capital gains tax Corporate tax Business Taxation in Australia |

Add to Reading List |

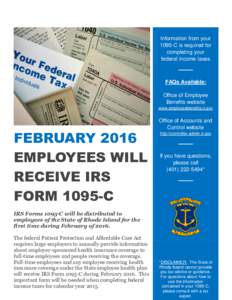

TAX LAW IN ONE PAGE 1. These rules apply to all enterprises, including Companies, Trusts, Partnerships, and Sole Practitioners. 2. All enterprises will be taxed on an annual basis, with the year from July 1 to June 30. P

TAX LAW IN ONE PAGE 1. These rules apply to all enterprises, including Companies, Trusts, Partnerships, and Sole Practitioners. 2. All enterprises will be taxed on an annual basis, with the year from July 1 to June 30. P