71 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-24 12:38:23

|

|---|

72 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-08 17:43:34

|

|---|

73 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-10 13:08:07

|

|---|

74 | Add to Reading ListSource URL: math.usask.ca- Date: 2016-09-19 10:23:36

|

|---|

75 | Add to Reading ListSource URL: math.usask.ca- Date: 2008-04-15 17:03:19

|

|---|

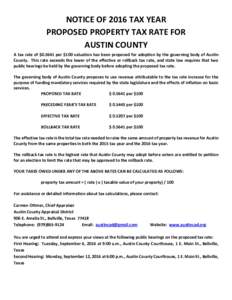

76 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-24 10:02:57

|

|---|

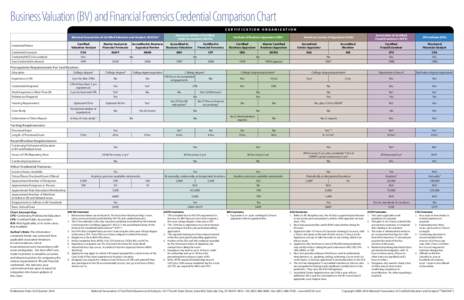

77 | Add to Reading ListSource URL: web.nacva.com- Date: 2016-04-15 16:13:59

|

|---|

78 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-16 08:37:34

|

|---|

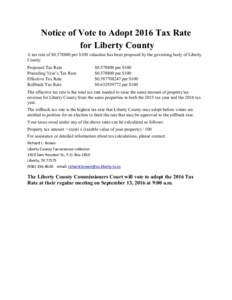

79 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-30 10:30:55

|

|---|

80 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-23 15:52:44

|

|---|