<--- Back to Details

| First Page | Document Content | |

|---|---|---|

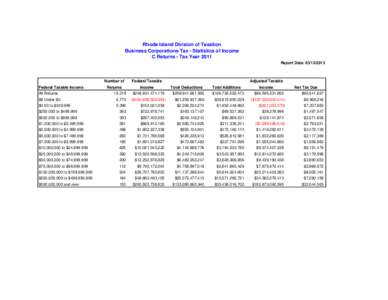

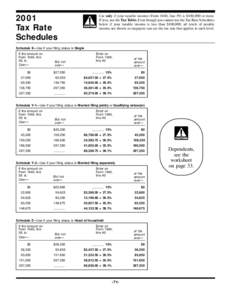

Date: 2014-07-28 07:29:42Government Income tax in the United States Federal Insurance Contributions Act tax Income tax in Australia Self-employment T1 General Taxable income Income tax Income taxes in Canada Taxation Public economics Political economy |

Add to Reading List |

T1 GENERAL 2011 Income Tax and Benefit Return Complete all the sections that apply to you in order to benefit from amounts to which you are entitled. For more information, see the guide. YT

T1 GENERAL 2011 Income Tax and Benefit Return Complete all the sections that apply to you in order to benefit from amounts to which you are entitled. For more information, see the guide. YT