Black–Karasinski model

Results: 5

| # | Item |

|---|---|

1 | Pricing of Options Exposed to Cross-Currency Rates Sebastian Jaimungal University of Toronto Dmitri H. RubisovAdd to Reading ListSource URL: www.fields.utoronto.caLanguage: English - Date: 2010-06-21 10:43:06 |

2 | On the pricing of Bermudan swaptions with an application to limited observed market data Mattias Jansson Royal Institute of TechnologyAdd to Reading ListSource URL: www.algorithmica.seLanguage: English - Date: 2005-04-19 06:48:00 |

3 | Semi-analytic valuation of credit linked swaps in a Black-Karasinski framework ¨ Peter Jackel Quant Congress EuropeAdd to Reading ListSource URL: www.awdz65.dsl.pipex.comLanguage: English - Date: 2009-05-19 13:11:19 |

4 | Semi-analytic valuation of credit linked swaps in a Black-Karasinski framework ¨ Peter Jackel Quant Congress EuropeAdd to Reading ListSource URL: www.pjaeckel.webspace.virginmedia.comLanguage: English - Date: 2011-07-26 17:45:39 |

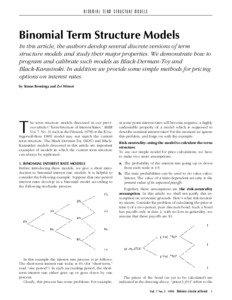

5 | PDF DocumentAdd to Reading ListSource URL: pluto.mscc.huji.ac.ilLanguage: English - Date: 1999-03-11 01:48:42 |